Julian Cook on 31 October 2025

End-of-Year Car Sales

December and January are among the best times to buy a new or used car. Dealerships are under pressure to clear out last year’s stock before the new models arrive, and that means big discounts, bonu ...

Rapid Admin on 15 August 2024

Bad Credit Loan Approval Tips

Essential tips for getting bad credit loans approved include understanding your credit report, fixing errors, choosing the right lender, demonstrating financial stability, avoiding red flags, reducing ...

Rapid Finance on 3 July 2023

How to Get a Car Loan with Bad Credit

Securing a car loan with bad credit might seem daunting, but with the right assistance, it's achievable. Rapid Finance, a trusted Australian broker, helps individuals navigate this process. Their appr ...

Julian Cook on 16 May 2025

The Power of Refinancing Your Home Loan

Refinancing your home loan can help reduce repayments, access equity, or secure a better rate — even if you have bad credit. This guide explains how refinancing works, when it makes sense, and how b ...

Julian Cook on 22 January 2025

Commercial Property Loans with Bad Credit

Explores how businesses, from sole traders to larger enterprises, can secure financing despite bad credit challenges. Practical steps like choosing the right lender, offering a larger deposit, and lev ...

Julian Cook on 6 January 2025

Are Cash Loans Right for Me?

Need quick cash for unexpected expenses? Learn the five key signs that a cash loan might be the right solution for you. From emergencies to short-term costs, discover how Rapid Finance can help you ge ...

Julian Cook on 2 December 2024

Top Tips when Applying for a Loan on Centrelink

Applying for a loan while on Centrelink is achievable with proper preparation. Understand eligibility criteria, organise documentation, check your credit status, and choose reputable lenders. Budget r ...

Rapid Finance on 17 July 2024

Escape the Rental Trap

For many Australians, escaping the rental trap and achieving homeownership can feel like an impossible dream. Traditional lenders often have stringent requirements that can be difficult to meet, espec ...

Rapid Finance on 27 March 2024

No Credit Check Car Ownership

This article highlights "rent to own" car agreements as an alternative for individuals with poor credit, bypassing strict loan requirements and offering a flexible, direct path to ownership. It detail ...

Rapid Finance on 8 November 2023

Is Car Refinancing Right for Me?

Explore the potential benefits of car loan refinancing in Australia with our comprehensive guide. Discover if it’s the right choice for your financial situation and how the expert team at Rapid Fina ...

Rapid Finance on 23 October 2023

The lender has the car as security: Why are they so concerned when I don’t pay on time?

So, you’ve obtained a car loan on your dream vehicle and are making your repayments on time. Then, you miss a repayment due to an unexpected event or just human error. Why does the lender care? Afte ...

Rapid Finance on 29 September 2022

How do enquiries influence your loan application’s success?

Do you know what an enquiry is, for example? It sounds innocuous, but a poorly timed enquiry could seriously harm your chances of securing a loan. The good news is knowledge is power, and the Rapid Fi ...

Rapid Finance on 29 September 2022

How old can a vehicle be for us to provide finance?

Although the ins and outs of car financing can be intimidating, Rapid Finance are experts and can often help customers find the right finance option in just a few easy steps – even with cars that ar ...

Rapid Finance on 16 September 2022

Things you need to know about loan pre-approvals

At Rapid Finance, we are very familiar with the loan approval process and do a substantial amount of loan pre-approvals for customers every single week. Pre-approval is one of the most important steps ...

Rapid Finance on 16 September 2022

How to handle a court judgement

If you’ve got a court judgement on your credit file, you’re definitely not alone. In fact, thousands of Australians have gone through court judgements after falling behind on their loan repayments ...

Rapid Finance on 16 June 2022

Life after a Part IX Debt Agreement

If you’re looking forward to discharge from a Part IX Debt Agreement, congratulations! It’s important to celebrate this milestone and take a moment to reflect on your financial journey – both th ...

Rapid Finance on 16 June 2022

Learn How Direct Debit Dishonours Could Damage Your Profile

Setting up a direct debit is a great way to pay for your goods and services on a recurring basis. Automatically and periodically taking out money from your account ensures that you pay bills, subscrip ...

Rapid Finance on 16 June 2022

The Biggest Loan Decline Reasons You Need To Know About

Whatever type of loan you’re applying for, there are so many factors that can impact whether or not you get approved. Getting a loan declined is a double-whammy because it means you don’t get the ...

Rapid Finance on 1 June 2022

Loans for Short Term Employment

When you’re looking for a car loan, it’s important to know what could improve your chances of securing your dream car and what could stand in your way. Whether you have a history of bad credit, a ...

Rapid Finance on 1 June 2022

Does Beforepay and MyPayNow Affect Car Loan Approval?

When you’re looking for a car loan, it’s important to know what could improve your chances of securing your dream car and what could stand in your way. Whether you have a history of bad credit, a ...

Rapid Finance on 1 June 2022

Help for Unpaid Defaults at Rapid Finance

If you’ve got a default on your credit file, you’re not alone. More people have bad credit than you think, but it doesn’t necessarily mean you can’t obtain credit - whether it’s for a car, a ...

Rapid Finance on 13 April 2022

Bank or broker for a mortgage/loan: Which is better for you?

When it comes to knowing the benefits and drawbacks of getting a loan with a broker or a bank, it’s easy to get confused because there’s essentially no right or wrong answer - it all depends on yo ...

Rapid Finance on 13 April 2022

Need an urgent loan, but worried about your bad credit?

If you’ve got your eye on a used car and need a loan to bag your bargain vehicle, it’s useful to know the ins and outs of car financing before you take the leap. Knowledge really is power when it ...

Rapid Finance on 13 April 2022

Wholesale network cars: how do we help customers locate them?

At Rapid Finance, we try to help you find the very best car deals as soon as your finance is approved. Once a lender agrees to your finance, we try to search our national network to find you the perfe ...

Rapid Finance on 13 April 2022

Why applying with Rapid Finance will not affect your credit rating?

At Rapid Finance, we’ve been helping people secure all kinds of finance for almost two decades; from cars to holidays - and even home purchases and refinancing, so we pretty much know just what it t ...

Rapid Finance on 15 March 2022

How to get a car loan for a used car

If you’ve got your eye on a used car and need a loan to bag your bargain vehicle, it’s useful to know the ins and outs of car financing before you take the leap. Knowledge really is power when it ...

Rapid Finance on 15 March 2022

Car loan approval time and procedure

Itching to get your hands on a new set of wheels? Unless you’ve saved up enough cash to purchase a car outright, buying a vehicle can involve endless searching for a car loan that will suit your sit ...

Rapid Finance on 15 March 2022

Smart ways to finance your car

A car can be one of the biggest purchases you’ll make, so finding the best car financing options in advance will always pay off. Whether you’re in the market for your first vehicle or just looking ...

Rapid Finance on 10 March 2022

Car loans and how payday loans affect your credit score

With so many ‘buy now, pay later’ type loans around at the moment, it’s important to keep updated with the relevant information so that you can make the most of your situation without getting ca ...

Rapid Finance on 1 January 2022

How many credit bureaus/credit reporting agencies are in the country

In Australia, there are three credit bureaus: Experian, Equifax and illion. So how do these agencies differ? ...

Rapid Finance on 22 February 2022

How 'buy now pay later' type loans could affect your credit score

With so many ‘buy now, pay later’ type loans around at the moment, it’s important to keep updated with the relevant information so that you can make the most of your situation without getting ca ...

Rapid Finance on 22 February 2022

How Do I Find My Credit Score?

Initially, the credit reporting system used to be based on the negative credit rating system – and only that. (Along with enquiries) Thanks to the introduction of Comprehensive Credit Reporting (CCR ...

Rapid Finance on 1 January 2022

Can I get a car loan with a bad credit check?

Whether you’re looking for an SUV, a sports car or a nifty little hatchback, no one wants past credit problems to stand in the way of getting a car loan. Millions of Australians use car financing to ...

Rapid Finance on 1 January 2022

What are the requirements for a car loan?

For most people, getting a car loan is a necessary step in buying a new or used vehicle. It’s not always possible to save up a lump sum amount to purchase a new set of wheels, and car loans can help ...

Rapid Finance on 14 July 2017

Car loans for discharged bankrupts: 4 golden rules

Features, reputation, flexibility. Maximise your chance of loan acceptance by following these 6 golden rules. ...

Rapid Finance on 26 June 2017

Apprentice loan options to get you on the road

Finding a loan as an apprentice may be easier than you think if follow these 4 steps. So let's get started. ...

Rapid Finance on 15 January 2024

How much can I borrow for a home?

You may be able to borrow more than you think. To discover your potential mortgage borrowing power, try our borrowing power calculator. It's fast, easy to use, and you'll get an estimate instantly. ...

Rapid Finance on 21 February 2017

Getting a Car Loan on Maternity Leave

Securing a car loan on maternity leave isn't always easy, but in many cases it is possible. Here are seven tips for increasing your chance of car loan success ...

Rapid Finance on 7 December 2016

How we find loans for people with bad credit

Turned down due to your credit history? Here's what you can do next to secure finance. ...

Rapid Finance on 1 December 2016

What are the best car loans for ABN holders?

Are you self-employed? Or are you a sole trader? Here's how you could get a better car loan deal with ABN car finance ...

Rapid Finance on 19 January 2024

Car loans for Uber drivers. What you need to know.

Whether you're an Uber driver or are thinking of becoming one, here's what you need to know about car finance ...

Rapid Finance on 10 November 2016

Low interest car loans for single mothers

Finding a low interest car loan as a single mother can be difficult. We're here to help ...

Rapid Finance on 29 September 2016

How long do I need to work for before I can get a bad credit car loan?

Here's how long you should work for before getting a bad credit car loan. ...

Rapid Finance on 8 November 2023

How common is car loan refinancing in Australia?

Thinking of refinancing your car loan? You're in good company. Refinancing is a popular loan solution in Australia today. Refinance and get new car loan terms that work for you! ...

Rapid Finance on 18 October 2023

The risks of no credit check car loans

Are no credit check car loans possible? And if they are, should you apply for them? Here are the answers to these questions and others regarding no credit check car loans ...

Rapid Finance on 4 January 2022

Can international students get a car loan in Australia?

Getting a car loan on a study visa is difficult. However, depending on your situation, it may be possible ...

Rapid Finance on 8 November 2023

8 Signs You Should Consider Car Refinancing

Whether you had bad credit when you first got your car loan or you simply need different features now, there are many reasons why people choose to refinance their car loans ...

Rapid Finance on 17 July 2023

Can I get a cheap car loan with bad credit?

This article provides valuable insights and strategies for securing affordable car loans for individuals with bad credit, emphasising the roles of financial discipline, professional advice, and choosi ...

Rapid Finance on 27 May 2016

Can I get a car loan if I'm on Centrelink?

Have you been denied a car loan because of your Centrelink benefits? You may still be able to get finance. Find out more with our handy five step guide ...

Rapid Finance on 2 March 2016

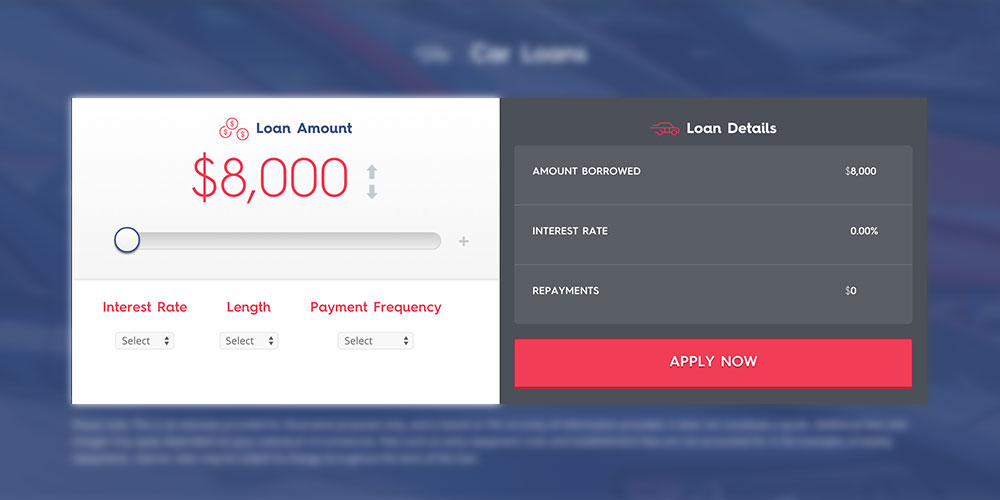

Using car loan calculators

Looking for a new car loan? Start your search here. This article explains how to use a car loan calculator and offers some useful tips for reducing your rate ...

Rapid Finance on 5 January 2016

Bad Credit Home Buyers Guide for Brisbane

Bad credit doesn't have to stop you from owning property in Brisbane. Our simple guide will get you on your way to owning your own home, bad credit or not! ...

Rapid Finance on 18 December 2015

Bad Credit Home Buyers Guide for Adelaide

This simple yet comprehensive guide covers the Adelaide property market for bad credit home buyers. Essential reading if you're from Adelaide! ...

Rapid Finance on 5 September 2024

First Home Buyer’s Guide

We share our property purchasing tips for potential first home buyers. Start your journey here ...

Rapid Finance on 22 August 2025

Getting a Home Loan on Centrelink Benefits

If you have a bad credit history or receive a Centrelink benefit, obtaining a home loan can seem like an insurmountable challenge. Start your search here ...

Rapid Finance on 15 September 2015

What is the Difference between a Part IX Debt Agreement and Bankruptcy?

Confused about bankruptcy? This easy guide will answer all your questions ...

Rapid Finance on 7 August 2015

Twenty Years of Car Loans and Still Going

What's our story? Director of Rapid Finance Michael Cullinan talks about founding Rapid Finance and the future of the industry ...

Rapid Finance on 5 August 2015

Can I Get a Car Loan on the Veterans’ Affair Pension?

If you're on the Veterans' Affairs Pension and looking for a car loan, then this guide is a great starting point. Read everything you need to know here ...

Rapid Finance on 11 June 2015

Should I use Salary Sacrifice to Buy or Lease a Car?

Find out what salary sacrifice is - and whether you could stand to benefit from using it - in our short guide ...

Rapid Finance on 1 June 2015

How Long do Defaults Stay on my Credit History?

Do you have a default on your credit file? Find out how long it stays on there, and what you can do about it in the meantime. ...

Rapid Finance on 5 September 2024

Can I get a Loan if I'm on Centrelink?

Can you get a loan if you're on Centrelink payments? Forget what you might have heard - the real answer might surprise you. ...

Rapid Finance on 29 May 2015

Do Pay Day Loans Affect Your Chances of Getting a Longer-term Loan?

Are payday loans good or bad? Discover the answers, and the alternatives, in our guide to payday loans. ...

Rapid Finance on 11 January 2022

Is it Possible to get a Car Loan While Unemployed?

If you’re unemployed, you may have a tough time getting a car loan. However, you may have a better chance than you thought ...

Rapid Finance on 26 May 2015

How to get a Low Doc Car Loan

Is it possible to get “low doc” or “no doc” car loans? We explain in our brief guide to getting car finance with limited documentation. ...

Rapid Finance on 18 October 2023

No Credit Check Car Loans

In Australia, all car loans involve a credit check. Even if you've got a few skeletons hiding in your closet (or credit file), you may still be able to obtain a car loan with bad credit. ...

Rapid Finance on 6 November 2023

What is Car Refinancing?

Have you had a car loan for at least 12 months? You may be in the ideal position to refinance your loan - depending on your personal and financial circumstances. Check out our top five tips on refinan ...

Rapid Finance on 20 October 2023

Can I get a Car Loan while Self-employed?

Just because you think you'll struggle to get finance while self-employed, doesn't mean that's definitely what will happen. Here are our expert tips on what you can do to get a car loan while working ...

Rapid Finance on 20 May 2015

Top Six Tips on How to Finance a Home with Bad Credit

Getting a home loan when you have a less than perfect credit history is not easy. But it’s not impossible. And if you know what to prioritise and what’s not as important, you may already be only a ...

Rapid Finance on 20 May 2015

Vehicle Stamp Duty - How Much do I Pay?

Knowing how much car stamp duty to pay - and when to pay it - is an essential part of the buying process. Yet many people are still unsure how to figure out the amount they should pay, and whether it' ...

Rapid Finance on 8 January 2015

What is a Centrelink Income Statement & How Do I Access It?

If you're applying for a car loan on Centrelink, your potential lender will require a Centrelink Income Statement. It could save you both time & stress to know what this document is & how to a ...

Rapid Finance on 22 December 2014

What is a Novated Lease?

A Novated Lease is a type of car finance for employees who want to purchase a vehicle as part of their salary package. Under a Novation Lease, there are three people who must come together to initiate ...

Rapid Finance on 22 December 2014

What is a Finance Lease?

A Finance Lease is a type of car loan used by businesses to finance commercial vehicles. They are commonly used for businesses that are looking to finance luxury vehicles or new models, and wish to do ...

Rapid Finance on 22 December 2014

What is a Chattel Mortgage?

A Chattel Mortgage is a type of car loan commonly used by businesses to finance vehicles that are intended for commercial use. Under a Chattel Mortgage, a lender will forward funds to their client to ...

Rapid Finance on 22 December 2014

What is a Commercial Hire Purchase?

Also known as a Hire Purchase or an Offer to Hire – is a common type of fixed rate car loan for businesses. As part of a CHP, a financial lender will agree to purchase the GST-inclusive amount of a ...

Rapid Finance on 19 December 2014

The Best Car Loans for Business

Each type of business car loan has its own unique benefits, suited to different sets of business requirements. Deciding on the most suitable car loan for your business is as simple as weighing your re ...

Rapid Finance on 10 October 2023

Can I Get a Car Loan With No Deposit?

Getting your vehicle loan application approved without paying a deposit is dependent on Loan to Value Ratio (LVR) & other considerations ...

Rapid Finance on 18 October 2023

Can I Get a Car Loan if I’m on Centrelink?

So how do you go about obtaining car finance to remedy your circumstance if you’re on Centrelink? Where there’s a will, there’s a way. ...

Rapid Finance on 29 July 2014

Can I Get a Car Loan with a Part IX Debt Agreement?

It’s easy to take your car for granted when it’s sitting in your driveway awaiting your instructions for take-off. But what if it wasn’t there. ...

Rapid Finance on 23 October 2023

What’s the Difference between Secured and Unsecured Car Loans?

This article differentiates between secured and unsecured car loans, emphasising the importance of informed decision-making in car financing. Secured loans offer higher approval chances, lower rates, ...

Rapid Finance on 12 July 2014

Can I Get a Loan if I’ve been Declared Bankrupt?

It’s a scary feeling when your financial stability slides. A financial adviser can help you create and stick to a budget, and your utility companies may offer you a hardship payment plan if you. ...

Rapid Finance on 1 January 2021

How Important is my Credit Report?

So you’re thinking of finally rewarding yourself with your dream ride. Or your rust bucket of a car has disintegrated, and it’s time for an unscheduled upgrade ...