Bad Credit Warning Signs & What it May Mean for Your Loan Application

The irony of a credit score is that, often people don’t realise what theirs is until they need to depend on it. Knowing your credit score can be crucial, especially when planning to make significant financial decisions.

For quick answers over the phone, speak to our bad credit experts on 1300 467 274.

More bad credit loan options:

- Bad Credit Car Loans - it is possible to get a car loan approved with bad credit with terms that suit you.

- Bad Credit Home Loan - it is possible to get a home loan, even with a bad credit history

- Bad Credit Personal Loans - getting approved may be easier than you think, even with a poor credit history.

- Car Loans on Centrelink - receiving benefits should not be a hurdle to getting your car loan approved.

Or continue reading to understand your best course of action.

If you're thinking about a major purchase such as a house or a car, you'll likely need a loan. Lenders will consider your credit history when you apply for that loan.

So, how do you know if you have bad credit? And what impact does it have on your loan application?

What is a Bad Credit Score?

Your credit score reflects the risk associated with lending you money from the lender's perspective. It's a sum of your credit history and indicates how reliably you can make repayments.

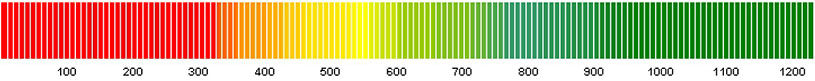

In Australia, credit scores are between 0 and 1200. The higher your score, the lower the risk you present to lenders, improving your chances of loan approval. A lower score suggests higher risk and could make securing a loan more challenging.

How Do You Get a Bad Credit Score?

Let's start by looking at maintaining a good credit score. It is about demonstrating financial responsibility, such as:

- Paying loans and bills on time

- Avoiding missed or late payments

- Being mindful of credit card limits

- Regularly checking your credit report for inaccuracies

- Correcting any errors on your credit report swiftly

Conversely, neglecting these practices can lead to a bad credit score, which can significantly impact your financial opportunities.

Warning Signs that You May Have Bad Credit

There are several indicators of bad credit, such as:

- Regular calls from debt collectors

- Receiving multiple letters regarding overdue payments

- Having outstanding debts across various accounts

- Notices of defaults on your credit files

- Being aware of any judgements against you

If you notice any of these signs, it might be time to take action to improve your credit score.

How to Check Your Credit Score

Checking your credit score in Australia can be done through agencies such as Equifax, Experian, or illion. This process can be free, but it's important to note that some services may charge a fee for faster access to your report.

Rapid Finance not only can provide you with a free credit check report, but can also help you to understand and address any issues in it. We can also work with you to help get your loan applications approved with terms and rates that suit your situation. Without having lots of 'hard credit checks' marks on your credit file - which will happen if you check multiple lenders directly.

Tips for Fixing Your Credit Rating

Repairing a bad credit score is possible by taking deliberate steps such as obtaining a small loan or a credit card and consistently making timely repayments. It's essential to manage any new credit accounts responsibly and keep debt levels low relative to your credit limits.

Improving a bad credit score may seem daunting, but it's achievable with the right approach. Here are five practical tips to help repair your credit rating:

- Check Your Credit Report for Errors: Obtain a free copy of your credit report from a credit reporting agency and scrutinise it for inaccuracies. Even small errors can impact your score negatively. If you find any discrepancies, report them immediately to the agency for correction.

- Set Up Payment Reminders: Late payments can severely affect your credit score. Set up reminders or direct debits to ensure all your bills and loans are paid on time. Over time, a history of prompt payments will improve your credit standing.

- Reduce Credit Card Balances: High credit card utilisation — that is, the ratio of your outstanding balance to your credit limit — can lower your score. Aim to keep balances low and pay off debt rather than moving it around to different accounts.

- Avoid New Credit Applications: Each time you apply for credit, it can trigger a hard inquiry, which may lower your score slightly. Apply for new credit sparingly, and only when necessary, to avoid accumulating hard inquiries.

- Seek Professional Advice: If you're struggling to manage your debt, consider speaking with a financial counsellor or a credit repair service. They can offer tailored advice and may help you negotiate with creditors or create a manageable repayment plan.

Remember, repairing your credit doesn't happen overnight. It requires discipline, patience, and consistency in your financial behaviour. By following these steps and showing lenders that you're a responsible borrower, your credit score will begin to improve over time.

How Will Bad Credit Affect Your Loan Application?

It's not impossible to get a car loan with a bad credit history. While it may be more challenging, certain lenders are willing to work with you. Rapid Finance has a history of assisting Australians with bad credit to secure loans for their dreams.

With more than two decades of experience, Rapid Finance offers personalised service to match loans to your individual circumstances. To explore your options for a loan, even with bad credit, speak to our experts on 1300 467 274.