Considering a no credit check car loan? Read this first.

The Risks and Realities of No Credit Check Car Loans

- No credit check car loans have notable downsides for borrowers.

- Such loans could potentially worsen your financial position.

- Considering a bad credit car loan? It might be a better alternative for many.

A Word of Caution to Borrowers

Securing car finance can prove challenging, especially when your credit history has blemishes like defaults or bankruptcies. When mainstream lenders turn you down, "no credit check" car loans might seem appealing. But is it genuinely a good idea? Let's delve deeper.

Understanding No Credit Check Car Loans

In Australia, no credit check car loans are an option, but they come with substantial drawbacks. Borrowers might find themselves paying more in the long run, and in certain situations, their financial health could be further compromised.

Hidden Costs and Limitations

Many borrowers, especially those rejected by multiple financial institutions, might see no credit check loans as their last resort. However, there are several factors to be wary of:

- High interest rates: Due to the perceived risk, lenders might apply significantly high interest rates.

- Large upfront deposits: Borrowers could be asked for considerable upfront deposits.

- Rigid loan options: Restrictive conditions, such as fees for early pay-outs or modifications.

Such loans might not only be expensive but could also strain one's finances, possibly leading to more considerable financial hardship.

Alternatives to No Credit Check Car Loans

If your situation permits, a bad credit car loan, which includes a credit check but is tailored for those with imperfect credit, might be a more suitable choice.

Need more information? Learn about no credit check car loans at Rapid Finance

The Lender's Advantage

While many loan types allow for negotiation and flexibility, no credit check car loans often come with conditions favoring the lender rather than the borrower. Some of these can include:

- Extended loan durations

- Mandatory direct debit payments

- Limited choice of vehicles

With these loans, borrowers may find themselves with little say in the loan terms, tilting the power balance towards the lender.

The Potential to Exacerbate Financial Strain

The costs associated with no credit check car loans can be substantially higher than with other types of loans. Their inflexible nature and the significant advantage given to lenders can increase the risk of default for borrowers. Ironically, a loan sought to overcome past credit issues might be the very factor that worsens one's financial standing.

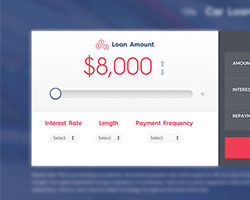

Car Loan Repayment Calculator

Find out how much you could potentially pay on your car loan with our car loan repayment calculator. Simply input your interest rate, loan term, and payment frequency to get an estimate.

Try the car loan calculator

Seek Guidance from a Specialist

While securing car finance with past credit issues can be daunting, a no credit check car loan isn't your only option. At Rapid Finance, we've been aiding Australians with less-than-perfect credit histories for over 20 years.

We have a dedicated team of finance professionals who could potentially assist you, even if other lenders have previously turned you down. To discuss your financial situation and discover the possibilities available to you, get in touch with us online or call 1300 467 274.

"No credit check car loans can pose major risks for borrowers."

Want to Improve Your Credit?

At Rapid Finance, our car loan specialists understand that life has its ups and downs. We're experienced in assisting those with complicated credit histories, offering options like bad credit car loans - which will limit the number of credit enquires before your loan approval. We've helped countless Australians secure suitable car finance tailored to their unique situations.

Discover more about our bad credit car loan options