Find a car loan that fits your budget, lifestyle, and goals. Flexible options and personalised support help you get behind the wheel sooner.

Call us on 1300 467 274

Find a car loan that fits your budget, lifestyle, and goals. Flexible options and personalised support help you get behind the wheel sooner.

Looking to reduce repayments or access better terms? Refinancing could give you more breathing room and a loan that suits your goals.

Past credit issues don’t have to stop you. Explore car finance options designed for applicants with defaults, missed payments, or low scores.

Ready to ride? Get motorbike finance for cruisers, scooters, or sports bikes with flexible terms and a simple, supportive application process.

Plan your next getaway with confidence. Caravan finance options make it easier to own the camper or van you’ve had your eye on.

Need vehicles, tools, specialist equipment or machinery for your business? Access equipment finance options tailored to cash flow, with fast turnaround and practical terms.

Rapid Finance could help you get the finance for the goods you want. We offer a range of loan and finance options, including:

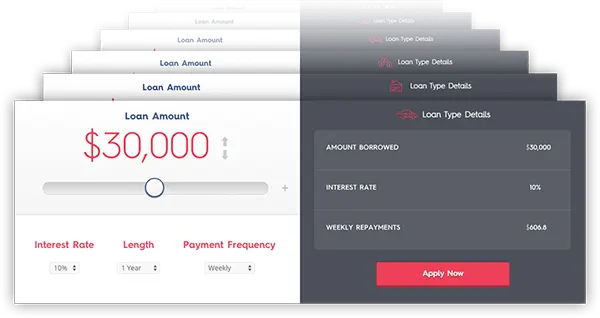

How much can I borrow? What will my repayments be? Get a projected estimate instantly using our online loan repayment calculator.

View our Loan Calculators

Since 2001, we've searched Australia-wide to match our customers with the right finance solution. Our expert team of loan specialists can find and recommend great car loans or home loans matched to your individual needs. So even if you've been declined by another lender, our 20+ years experience means we could still find you the right deal.

Rapid Finance has also achieved a 10-Year Membership with the MFAA. As Australia's foremost organisation representing mortgage and finance professionals, the Mortgage & Finance Association of Australia is dedicated to upholding superior standards of professionalism, ethical conduct, and best practices across the industry.

Rapid Finance isn’t just a name - it’s what we do. Complete our easy online application or phone assessment and get a fast response.

Our unrivalled knowledge means we can answer all your questions - quickly. Not sure which loan is right for you? That's okay, here are some popular links to get you started.

Bad Credit Loans | Bad Credit Car Loans | Car Refinancing

Banks sell you the loan they want. We listen to what you want.

And thanks to our huge range of lending products, we could get you a competitive rate tailored to your specific circumstances. Not sure which loan is right for you? That's okay, here are some popular links to get you started.

Bad Credit Loans | Bad Credit Home Loans | Home Refinancing | First Home Buyer Loans

Our expert team of car loan specialists could find and recommend great car finance matched to your personal or business needs. We are driven by a passion for finding great automotive finance solutions for our customers, no matter who they are.

Car Loans | Car Loans on Centrelink | Car Refinancing | Business Car Loans

We could help get your Centrelink loan application approved, quickly and easily - apply with no extra marks on your credit file!

We could help you with a bad credit car loan. Get your second chance car loan with the help of Rapid Finance.

Getting a car loan on Centrelink may be easier than you think. We could help get your car loan approved.

As experts in bad credit loans and finance, we could help you to get your bad credit loan approved with terms that suit your needs and with affordable repayments to match your budget.

Refinance your home loan for a better rate, lower repayments, consolidating debt, renovating, investing, or accessing cash—bad credit? We could help.

Yes, it is possible to get a home loan on Centrelink. As experts in alternative home finance, we could help get your application approved with affordable terms.

Rapid Finance is a specialist broker, with over 20 years experience finding loans and finance that suit our customers' unique circumstances. We cater to a variety of needs including car loans, bad credit, debt consolidation, and home loans with low deposits, as well as a wide range of other bad credit personal loans. We offer a tailored service based on your needs and will work to find the best deal and loan for you. We can assist through the whole process, from rebuilding your credit rating, in some situations, to finding the best loan for you and guiding you through the options and application process.

We offer a number of different loan types from personal loans, home loans to vehicle loans.

There are several advantages of applying for a loan through a broker, especially if you have bad credit:

Remember that while brokers can help you navigate the lending market, some may also charge fees for their services (there is no charge to you when applying through Rapid Finance), and not all brokers will have access to all lenders. Always do your research to understand what a broker can offer you before deciding to work with them.

Yes, it is possible. Rapid Finance have over 20 years experience assisting customers get home finance. Whether it is due to low deposit, bad credit or wishing to refinance, we are experts in bad credit home loans.

Yes, it is possible, and it may be easier than you think with Rapid Finance. We are specialists in bad credit car finance and can review your application and credit history to match you with the right lender at a competitive rate, that suits your circumstances. We have over 20 years experience helping people with bad credit get car finance, that works for them.

Yes, you've come to the right place! We are specialists with over 20 years bad credit expertise. Assisting our customers get their bad credit personal loans approved, with repayment terms that work for you and your situation.

See also our Centrelink loan options and cash loan pages.

You must be a permanent Australian resident or on a visa that allows you to work in Australia for the next 3 years. Apart from that, we can review your income, whether it is from employment or Centrelink benefits, whether you work full time, part-time, causal or contract, and we can even fund loans for the self-employed.

If you have bad credit - we can generally help with that too. It doesn't matter if you have defaults on your credit file, late bill payments, Part 9 Debt Agreement, Court Judgements or a discharged bankruptcy - we have a range of specialist lenders who can accept all kinds of bad credit. If it makes more sense to fix up your credit file first; we'll let you know what you need to do, in order to improve your credit rating.

Learn more about Our Process and how we could help to get your next loan approved.

With Rapid Finance, we offer a free credit check report. Your credit report gives you an insight into how lenders and other service providers may view you in terms of reliability and financial management. This understanding can help when you're planning to apply for any kind of loan. By regularly checking your credit report, you can understand the factors influencing your credit score. This knowledge can help you take steps to improve your score over time, such as fixing errors in the report, paying off debt or ensuring bills are paid on time.

In Australia, credit scores range from 0 to 1200, depending on the reporting bureau. Here is the typical breakdown:

The range varies between the below credit reporting agencies.

These agencies collect information about your credit history, including loans you have applied for, defaults on loans, your repayment history, and court judgements. They use this information to create a credit report and calculate a credit score, which lenders can use to assess your credit risk.

If your score is in the "below average" range, it may be harder for you to get a loan or credit, or you might have to pay a higher interest rate. If you're in this situation, you might want to look into ways of improving your credit score, such as paying your bills on time, limiting your number of credit inquiries, and reducing your overall debt. Complete our free credit check form to get started.

Generally, gambling does not directly impact your credit score. Credit scores are calculated based on factors like your payment history, the amount of debt you owe, the length of your credit history, the types of credit you use, and the amount of new credit you have.

However, gambling can indirectly affect your credit score in a number of ways:

It's also worth noting that while gambling transactions themselves do not show up on your credit report, taking out cash advances on a credit card to gamble can be visible to lenders, as can any loans or credit used to gamble. Lenders may consider these behaviours risky, which could impact your ability to secure credit in the future.

Remember, if you feel that gambling is negatively affecting your life or finances, it's important to seek help. There are many resources available for people dealing with problem gambling.

Whether you're buying or upgrading, explore home loan options with flexible features and support from application through to settlement.

Refinance to lower repayments, access equity, or find a loan that better matches your current goals — all with guidance tailored to your situation.

Credit challenges don’t have to end your homeownership plans. We partner with lenders who consider your full financial story, not just your past.

Cover life’s expenses with a personal loan designed around your needs. Simple applications, fair terms, and options for a range of situations.

Centrelink income can still work for finance with our partners. Explore personal loan options that assess your overall affordability, not just your payment type.

When you need money fast, quick cash loans offer a fast process, straightforward requirements, and flexible repayment options.

If your credit isn’t perfect, you still have options. Compare loan choices designed to give you a fair chance and a clear path forward.

Combine multiple debts into one easy-to-manage loan. Reduce the stress of juggling repayments and take back control with a clearer, more affordable path forward.